EXPENSE MANAGEMENT

Easily manage reimbursements without manual processes

What it does

Simplify expenses for everyone

Tired of manually entering receipts, checking their validity and making sure they’re accurately reimbursed in payroll? You deserve better than paper-based busywork. That’s why our employee expense tracking software lets your people easily track and submit their own mileage and expenses, so you don’t have to. Once they do, that data flows seamlessly through approvals and into payroll. Meanwhile, you eliminate error-prone rekeying and an endless chase for approvals, all while adhering to company policies.

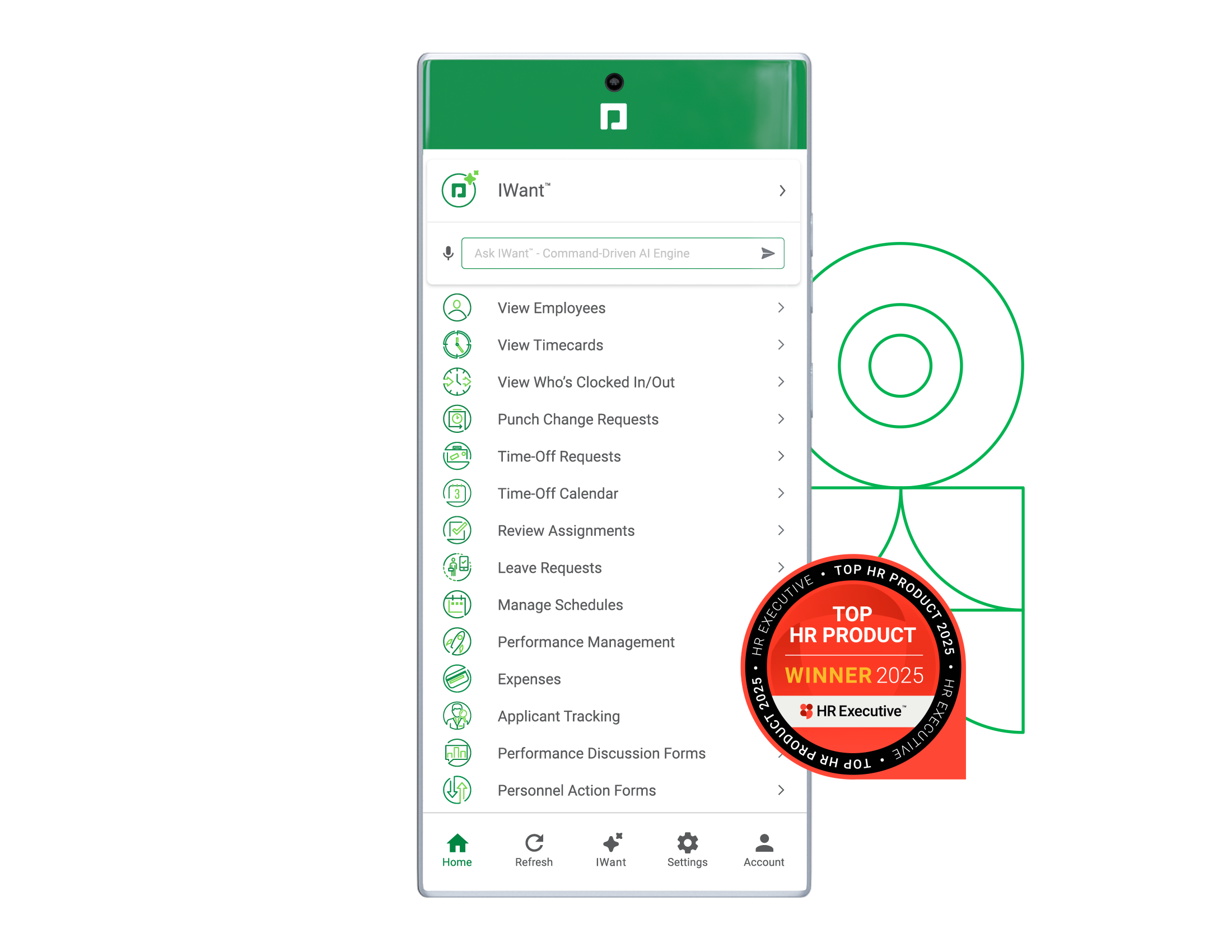

IWANT

The employee data you need — all at your command

We’ve revolutionized how users find and access employee data. Instead of hunting for the info you need, simply ask IWant™ — the industry’s first command-driven AI engine in a single database. It searches employee profiles and management dashboards to deliver instant, accurate answers.

Full-solution automation

One software to end manual reimbursement

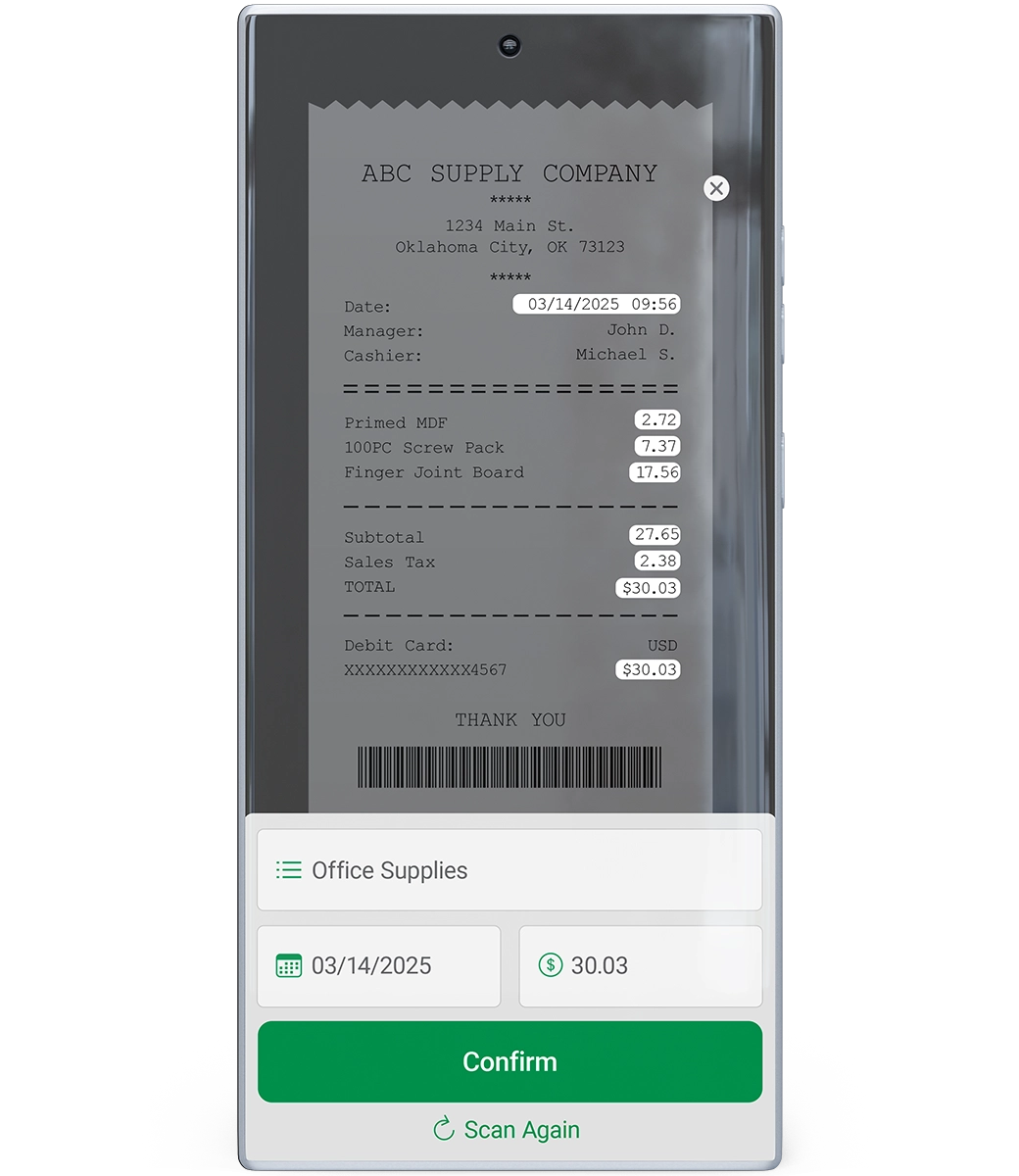

Even if you have a system to help handle expenses, that doesn’t mean it lightens your workload. Because our Expense Management software exists in a truly single software, it automatically connects with our other tools. After an employee uploads or snaps a photo of a receipt, Paycom autopopulates the necessary fields. From there, our tech notifies managers or auto-approves expenses based on criteria you set — no need to separate them into high-level categories.

Expense Management automatically:

- alerts employees about expense decisions

- matches stored receipts to your corporate card

- allocates expenses from your general ledger

- calculates traveling rates (with our FAVR and Mileage Tracker tools)

- feeds approved expenses into payroll

Seamless workflows

Effortlessly create and manage expense properties, policies and approval workflows to free you from time-consuming tasks.

Big-picture reporting

Readily track — not manually manage — expenses with automated reports and the payroll dashboard, so you can stop being a middleman and focus on strategy.

Self-service submissions

Our software makes it easy for employees to enter receipts and warns them of duplicate entries, so your company doesn’t accidentally overpay.

Manager insight

From viewing and approving requests to flagging redundant receipts, our tech lets your leaders manage expenses right from the Paycom app.

True transparency

Using Employee Self-Service®, your employees can check the status of their pending reimbursements without pulling away from work.

Unquestionable security

Like every tool in our single software, Expense Management is guarded by industry-proven, ISO- and SOC-certified security standards.

See what people are saying about expense management

Frequently asked questions

Learn more about expense reimbursement

Employee expense tracking software simplifies the process of submitting receipts and mileage to later be reimbursed through payroll. Paycom’s Expense Management tool, for example, makes it easy for employees to upload their expenses and automates tedious aspects of the process for HR. By doing so, this tech eliminates manual data reentry and prevents errors, like paying out the same receipt twice.

Paycom’s Expense Management tool simplifies expense approval and management for everyone involved. First, it allows employees to scan and upload receipts right from their phone. It even autopopulates relevant fields from just a picture and warns them if the expense is a possible duplicate entry.

From there, expenses automatically flow to managers for approval, allowing them to make a decision right from our easy-to-use app. Finally, that data flows seamlessly into payroll, allowing HR to track any pending reimbursements through an intuitive dashboard. Our Expense Management tech also gives HR and payroll pros insight into outstanding approvals, so they can address any bottlenecks quickly and without needlessly chasing down leaders.

Yes. Paycom allows you to set your own approval chains for expense requests. After you enter the relevant assignments, submitted receipts and mileage will automatically and securely flow to only those who need to review them.

Our Expense Management software automatically warns employees if the receipt they’re attempting to submit is a possible duplicate. Should they proceed with submitting it, Paycom flags the entry for their managers. Finally, Expense Management allows you to easily produce reports and filter them based on possible duplicate entries, giving you yet another line of defense against overpayment.

Since our employee expense tracking software exists in the same single software as all of Paycom’s tools, approved reimbursements flow seamlessly into payroll. No need to hop to another system with separate login info. Once expenses are approved, that’s it. HR can simply monitor them for accuracy.

Yes. With Paycom, approved expenses seamlessly flow into payroll. This allows employees to easily view upcoming reimbursements and lets HR monitor the process from a high level, freeing you from unnecessary manual tasks.

Yes! With our optional Mileage Tracker tool, you can automatically track your employees’ business miles. Take this a step further with FAVR, an optional tool that autocalculates rates based on a precise location using the national per-mile average, which is determined by the IRS.

Yes, your people can use our self-service app to easily submit expenses. They can even just snap a photo of a receipt, and our AI-assisted tech will autopopulate any relevant fields. It’s that easy.

Absolutely! Our Expense Management tool offers the ability to link stored receipts to assigned corporate credit card numbers by employee. This means you no longer have to chase workers down for clarity you should’ve already had.

Expense Management allows employees to submit expense reports, upload or snap a photo of receipts, track mileage and monitor the status of their pending expenses. The tech allows managers to review, approve or deny expense reports, ensuring compliance with company policies. Meanwhile, HR and payroll staff can establish expense policies, create approval workflows and generate reports for strategic analysis.

Best of all, this functionality exists within Paycom’s single software, streamlining the entire expense management process, reducing errors and improving efficiency overall.