In a December 2023 updated report, Ernst & Young (EY) found the average cost per manual data entry made by an HR professional increased to $4.78. Read about EY’s latest findings for more information.

Is the power of HR where it should be — in your employees’ hands? As your business grows larger, so too does the need for you to access and understand all of your practices and systems. But when you outsource your HR to a professional employer organization (PEO), you give away control, insight and, ultimately, the possibility of an HR solution that scales with the unique needs of your enterprise.

Not sold? No problem — there are plenty of reasons to give your PEO the boot and try a streamlined HR tech solution. In fact, I’ve got six for you:

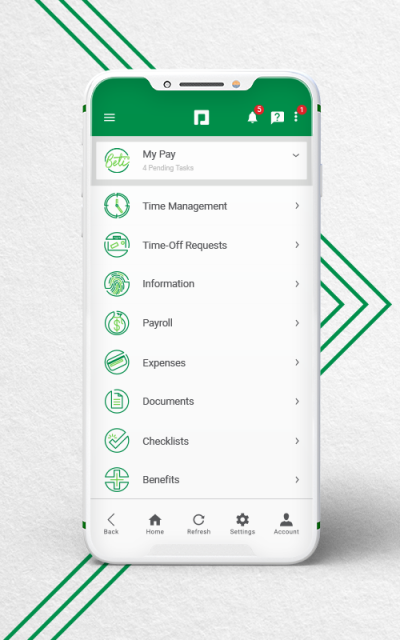

1. Anywhere, anytime access

Imagine the last time you needed an important piece of information from your PEO. How long did it take them to get it to you? An hour? A day? A whole week?

I know it’s longer than if your workforce had that access all along. Through Employee Self-Service®, your employees have comprehensive access to their data whenever they need it without asking HR. Plus, our industry-first payroll experience, Beti®, allows employees to do their own payroll, giving them unmatched clarity into their paycheck and your HR professionals more time to focus on strategic endeavors.

2. Ease administrative burdens and risks

Every manual HR task has a cost — an average of $4.70 according to Ernst & Young’s latest research. That’s not to mention what can’t be measured until it’s too late: your liability.

When your employees use self-service tech, you solve many of the most time-consuming pieces of the HR puzzle that PEOs can’t address. Plus, Beti helps reduce your liability by giving a layer of paycheck approval to the people who know it best: your employees.

3. Boost compliance

With new legislation emerging all the time, you need an hr compliance solution that’s equally responsive and up-to-date. Our tools are updated frequently to help you stay compliant with laws relating to:

- family leave

- minimum wage

- and more!

Paycom even publishes monthly series to give you a proactive step up on regulatory challenges.

4. Dedicated, personalized support

Each of our clients are assigned a dedicated specialist that’s committed to your success and backed by our implementation and long-term support teams, regardless of your organization’s size and national location. Say goodbye to extended hold times or tough-to-navigate call centers and hello to straightforward, readily available help.

5. Customizable benefits administration

Your benefits package should be a key part of your retention strategy, not a nightmare for your admins. With a tool that allows employees to enroll in benefits themselves, automatically updating their payroll deductions while giving them anytime, anywhere access to their plan information.

Looking to roll out some unconventional options? No problem! Our benefits administration tool allows you to easily add benefits, and your workforce can even preview the impact of a certain deduction on their pay before they confirm it, giving them greater understanding and you reduced liability.

For added assurance, we also offer the option for a dedicated coordinator to ensure your enrollment is easy and painless as well as a tool that automatically updates your providers with any plan changes, so you can stop losing time to unnecessary phone calls and confusion.

6. Observable, real-time ROI

Does this sound too good to be true? It might be if we didn’t have a way for you to measure this advantage.

Our reporting tools grant you access to the powerful analytics you need to see your employees’ HR tech usage in action as well as how you can take their engagement further. The interface is intuitive and informative and doesn’t require back-and-forth communication with an uninvolved third party, so you can quickly identify what you need to know and convert it into strategic initiatives.

Ready to make the switch? Learn more by exploring Paycom’s solution today.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.