What comes to mind when you think of the consequences of a payroll error? Passing on a night out with friends? Putting off a large purchase until next payday? Making a few compromises about a vacation?

Sure, all those scenarios speak to inconvenience. But for a staggering number of Americans, payroll errors are devastating.

In fact, 61% of Americans live check to check, according to a Morning Consult survey commissioned by Paycom. On top of this, the same research also revealed 40% would be vulnerable to poverty if they missed one payday.

For the millions of employees living in near poverty, payroll must be perfect. A single payroll error could subject them and their families to:

- higher stress

- increased debt

- deactivated utilities

- food insecurity

- homelessness

No employer wants to put their people in this position. But can any business truly promise they won’t without technology that guides employees to find and fix errors before payroll runs?

You might ask, “Isn’t this all blown out of proportion? If our payroll’s wrong every once in a while, what’s the big deal?” Those are great questions if you have the privilege of a meaningful savings account and a solid network of support. Unfortunately, the reality for many people is much more troubling.

But there’s a way to help. First, we’ll examine the correlation between payroll errors and poverty. Then, we’ll discuss how a business can protect its most vulnerable employees.

How are payroll errors and poverty connected?

Payroll errors have always been a problem, but their impact is magnified in our current economy. The COVID-19 pandemic, inflation and other recent socioeconomic factors have made life difficult for an increasing number of employees.

In 2021, 115 million people fell to “extreme poverty,” defined by The Brookings Institution as those living in households spending less than $1.90 per person, per day. The research also estimates this number will increase by more than 400 million by 2030. Every month, it grows harder for many to just make ends meet.

While more people sink into poverty, so does the number of Americans living on the cusp of it. For the 4 in 10 U.S. households that are “liquid-asset poor,” poverty is just one payroll error away according to Prosperity Now, a nonprofit studying economic impacts. Even a day without a correct payroll could force employees living on this thin line to:

- miss car, credit card, rent or mortgage payments

- decide which utility bill not to pay

- cut down an already modest grocery list

- put off needed home or vehicle repairs

Employees need greater insight into their payroll and assurance it’s correct. Not just for their own sake, but their family’s as well.

Poverty rarely afflicts just one generation. Its effects can domino into decades of hard times. The right tech ensures payroll is perfect before it runs and helps employees manage their households’ financial future.

Stress is already at an all-time high for employees everywhere, according to Gallup. And if a worker is already worried about their family’s finances, avoidable payroll errors make a stressful situation dire.

How do businesses prevent payroll errors?

What if there was a way for employers to give their people one less thing to worry about? Is it possible for a business to help its employees and their families live a healthier and financially stable life?

Absolutely. It starts with an enhanced, fully transparent payroll process.

With an employee-driven payroll experience, workers have the power to resolve payroll issues before they wreak havoc on their livelihood. After all, mistakes in the payroll process are inevitable. What makes them a problem — one that could send an employee into poverty — is when they’re not caught in advance.

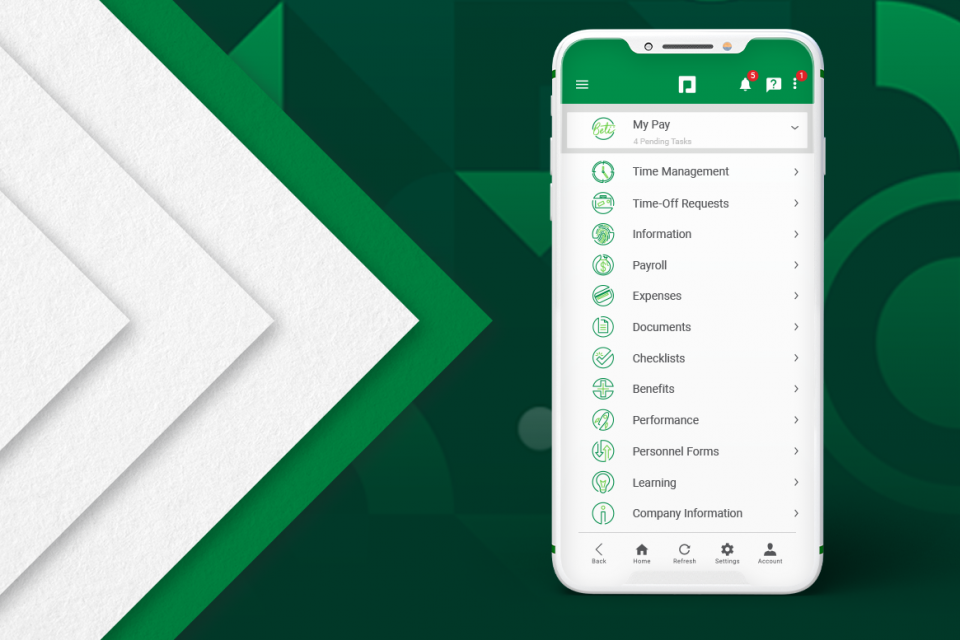

Paycom’s Beti®, for instance, guides employees to find and fix errors before payroll runs — right in the Paycom app. Beti gives workers priceless peace of mind knowing they’ll be paid accurately and on time, so they can:

- proactively plan their expenses

- allocate for savings

- review and verify the hours they work

- manage their financial future

Plus, if there’s any issue with their pay that they can’t resolve themselves, employees can use Paycom’s Ask Here tool to quickly contact the person in the organization best suited to help them.

Meanwhile, employers gain the advantages of a focused and inspired workforce, like:

- higher engagement

- lower liability

- improved accuracy

- greater efficiency

- increased process oversight

Employee-driven payroll may not put an end to poverty, but it has the potential to help millions of Americans work and live better.

Explore Beti, Paycom’s employee-driven payroll experience, to learn how it helps protect every employee, including the most vulnerable.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.