As HR professionals, we know payroll is constant. Given this process impacts every employee we help, it needs to be accurate and consistent. The quality of payroll has the power to set a precedent for an employee’s entire experience.

But even seasoned HR teams still feel a huge amount of payroll pressure. After all, small mistakes can spur costly and time-consuming adjustments. Plus, insight into payroll is increasingly important to today’s top talent. This means achieving a perfect process is key.

Luckily, errors and mystery don’t have to be an inevitable part of payroll.

With a proactive and automated payroll experience, it’s possible for HR teams to alleviate their stress with help from the people the process affects most: employees!

HR without automated payroll

I remember when timecards were reported manually, withholdings weren’t calculated automatically and direct deposit wasn’t an industry standard. Of course, payroll has evolved significantly since then.

Yet many in HR still wrestle with the same issues, including:

- miskeyed data

- missed time punches

- incorrect benefits

- miscalculated deductions

- failed direct deposits

These are just a few of the scenarios HR teams tiptoe around, and each provide a similar outcome: increased stress. In fact, a late 2021 OnePoll survey commissioned by Paycom of 300 U.S. payroll professionals reveals 4 in 5 are stressed by the process, and 64% have made retroactive corrections due to a mistake.

Faulty payroll isn’t just a pain point for HR, either. According to the OnePoll survey, an overwhelming 91% of respondents claim payroll errors break the trust employees have in their organization. Imperfect paychecks are more than just inconvenient; they could spur disengagement and turnover.

We’ve come a long way, but this data suggests there’s still ample room to enhance and clarify the process. And we have the tech to help us do it.

Processing transparency for HR and accounting

Every payroll error sparks a chain reaction for HR and accounting alike. Every correction — such as tracking down the source of an error or quickly cutting a paper check — has a price. And getting to the bottom of a problematic payroll robs us of precious time we could use instead to focus on more important initiatives.

That’s not to mention the added liability payroll issues may bring. But when employees have the ability to verify, troubleshoot and approve their paychecks before payroll runs, it gives us a proactive edge over stress-inducing errors.

Let’s consider the HR vice president of a luxury auto rental company. Before her business used proactive and automated payroll software, it had trouble with:

- employees accurately reporting their time

- multiple disjointed systems

- a time-consuming process resulting in 15 to 20 post-payroll changes

Soon after it embraced a self-service experience, her team’s retroactive adjustments plummeted. In turn, they were able to reduce their payroll stress and focus on what HR does best: finding new ways to empower employees!

Processing transparency for employees

Again, while faulty payroll is a point of stress for HR professionals, we’re not who it affects most. A study from the American Payroll Association reveals 63% of employees live paycheck to paycheck. For a vast majority of our co-workers, their pay is everything.

their pay is everything.

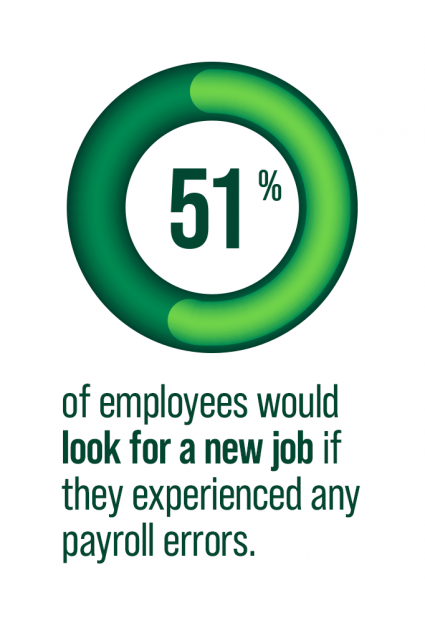

It should come as no surprise that 51% of employees would look for a new job if they experienced any payroll errors, according to a 2021 survey from The Harris Poll. This risk may place many organizations at a critical juncture.

With payroll processing transparency, employees know what to expect in their paycheck early so they can plan accordingly. Plus, proactive and automated payroll empowers them with an opportunity to flag a mistake in advance, before it shifts into a costly — and turnover-inducing — issue.

And the data proves our workforces want this agency. In the study by The Harris Poll, 74% of employees claim they would prefer the ability to update and verify the information that impacts their paychecks themselves. It makes sense, given the same survey shows almost as many employees have experienced an issue with their paycheck. Through a proactive payroll experience, they not only have this power; it’s right at their fingertips!

While employees reap this key benefit, their leadership can enjoy better retention, enhanced ROI and true strategic partners in their HR professionals.

To join me and learn more about how greater transparency through proactive and automated payroll helps an entire organization, register for this webinar. And explore Beti®, Paycom’s proactive payroll technology, to see how it delivers an experience to empower employees and HR.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.