Expense reports are as commonplace as HR itself. From reimbursing a team outing at a pizza parlor to room and board for an international conference, expenses are tethered to nearly every aspect of a business’s growth. While it can be difficult to imagine expenses tracked in anything less than an electronic spreadsheet, the roots of expenses — and how we manage them — may be deeper than you think.

The dawn of expenses

The very first expenses can be linked to the birth of the calculator around 2500 B.C. The Sumerian abacus not only enabled the evolution of arithmetic in ancient Mesopotamia, but the first form of record keeping as well. Though rudimentary by design, this historic advent gave future civilizations the platform to implement other revolutionary aspects of commerce.

Near the end of the Bronze Age, the first proof of an expense began to take form. Around 1300 B.C., ancient Egyptians began to use papyrus to record the purchase of grain, livestock and other valuable materials. These documents were effectively the first receipt, a critical component of today’s expense report.

The way we managed expenses continued to grow throughout the Industrial Revolution. By the first half of the 20th century, the relatively new Internal Revenue Service (IRS) implemented greater federal regulation. The earliest federal tax laws identified a need for “ordinary and necessary expenses” to be deducted by business owners. In fact, this notion is so innate to the way we conduct business, the bulk of the IRS Code’s guidance on the subject has gone unchanged for over a century.

The modern era

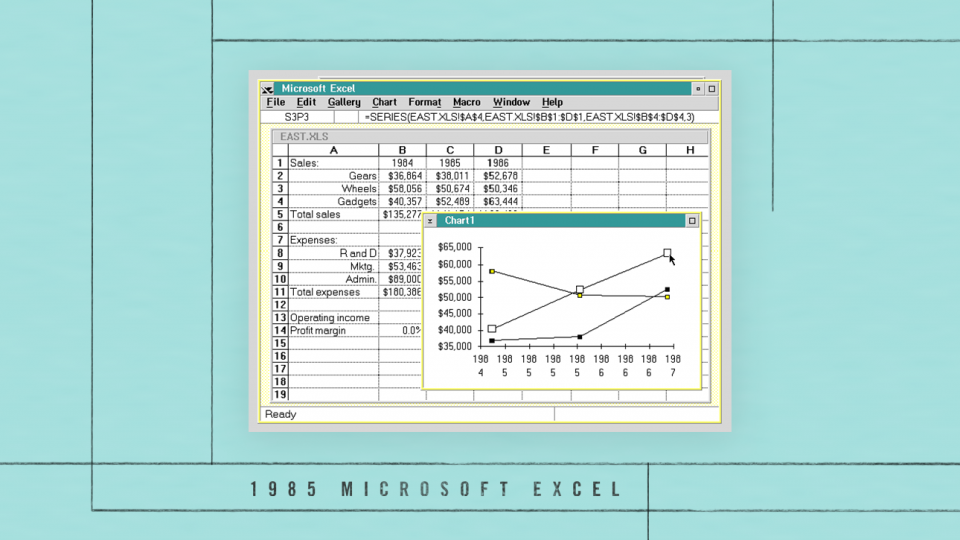

As businesses evolved and prospered, the scope of our expenses began to change. The need to record transportation, airfare, hotel costs and other expenses associated with a thriving organization began to add up. Likewise, technology emerged to better address this development and help ensure accurate and efficient record keeping. The first spreadsheet software with financial functionality, Visicalc, was a significant milestone on the timeline of business technology in 1978. This would go a step further in 1985, when Microsoft unveiled Excel, a tool that is still used commercially today.

However, even these improved tools were held back by a fundamental issue: They were stationary. By the time we entered the new millennium, cutting-edge technology would provide an opportunity for expense management software to become even more accurate and convenient.

Expense management today

The emergence of smartphones brought an unprecedented amount of possibilities. Now with the benefit of mobile apps, expenses can be recorded the same way money is spent — on the go.

Take, for example, Paycom’s Expense Management tool. With the ability to take photos of receipts and easily upload them through Employee Self-Service®, there’s no need to hold on to paper documents, significantly reducing the risk of unaccounted expenses. This also gives HR an opportunity to easily view transactions, request receipts and deny charges. And with the latest update to the Expenses Dashboard, you can readily identify pending requests and possible errors, such as duplicated transactions.

Additionally, our updated Mileage Tracking makes it easier than ever for employees to submit business mileage through the Paycom app. You can also preview routes and customize your mileage rate so you can better ensure you don’t overpay on reimbursements while staying IRS-compliant.

When these expenses flow seamlessly into payroll, it mitigates the need for time-consuming data entry. Your expense data works hand in hand with Paycom’s reporting tools as well, providing insight into your regular business expenses so you can make informed decisions moving forward. Direct Data Exchange® for example, provides a comprehensive, easy-to-read analysis of your employees’ tech usage as well as the proficiencies your organization gains as it digitally transforms. And with Beti®, our industry-leading, employee-driven payroll experience, your workforce can see if an expense reimbursement will be reflected on their paycheck before payroll runs.

Are you ready to experience the next level of expense management? Learn about our solution and discover more about the journey of HR through our HR:evolution series on YouTube and the Paycom blog.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.