In a world of unnecessary HR tasks, employees and employers have a new champion. Equipped with cutting-edge Paycom technology, Unnecessary Action Hero is changing the game. He’s taking the battle to unnecessary tasks that slow you down when your HR tech is lacking. Learn about his ninja-like techniques and put them to work for you.

Payroll pitfalls

When employees don’t review and approve their own paychecks, what could go wrong? Besides erroneous expenses, underpaid mileage, incorrect deductions and general, run-of-the-mill blunders? According to a OnePoll survey of HR, payroll and accounting professionals, 91% agree errors impact employees’ perception of their employer and breaks trust.

But Unnecessary Action Hero won’t take it lying down. He’ll take it with a roundhouse kick and a healthy dose of Beti® from Paycom. With Beti, employees do their own payroll and approve their own paychecks. Hasta la vista, unnecessary payroll errors.

Benefit blind spots

Employees give it their all to earn much-needed benefits. But in a June 2022 Pollfish survey of 1,000 U.S.-based workers, 41% said viewing all of their benefits was their most frustrating HR challenge. Here’s a question: Can your employees enroll in benefits on their own without sucking up your time? Do they have 24/7 access to plan documents? Can they easily review this crucial annual decision alone or with family members?

Too often, the answer is a resounding “no.” But Unnecessary Action Hero is on the case with a fistful of justice and Paycom’s Benefits Administration. It empowers employees to enter their own data, test payroll deductions, customize plan setup and more. Yippee ki-yay, paper enrollment forms. There’s a new HR sheriff in town.

The PTO goose chase

When it comes to benefits, PTO is solid gold. It rejuvenates your workforce and helps them power through the busy times. Yet far too often, employees don’t know how much PTO they’ve accrued. Time-off requests can stay in limbo for days or even weeks. And employees can only submit requests during the work week – not on nights or weekends when people often spend time planning trips. That’s a hassle for employees. And when they have to get you involved, it wastes your time, too.

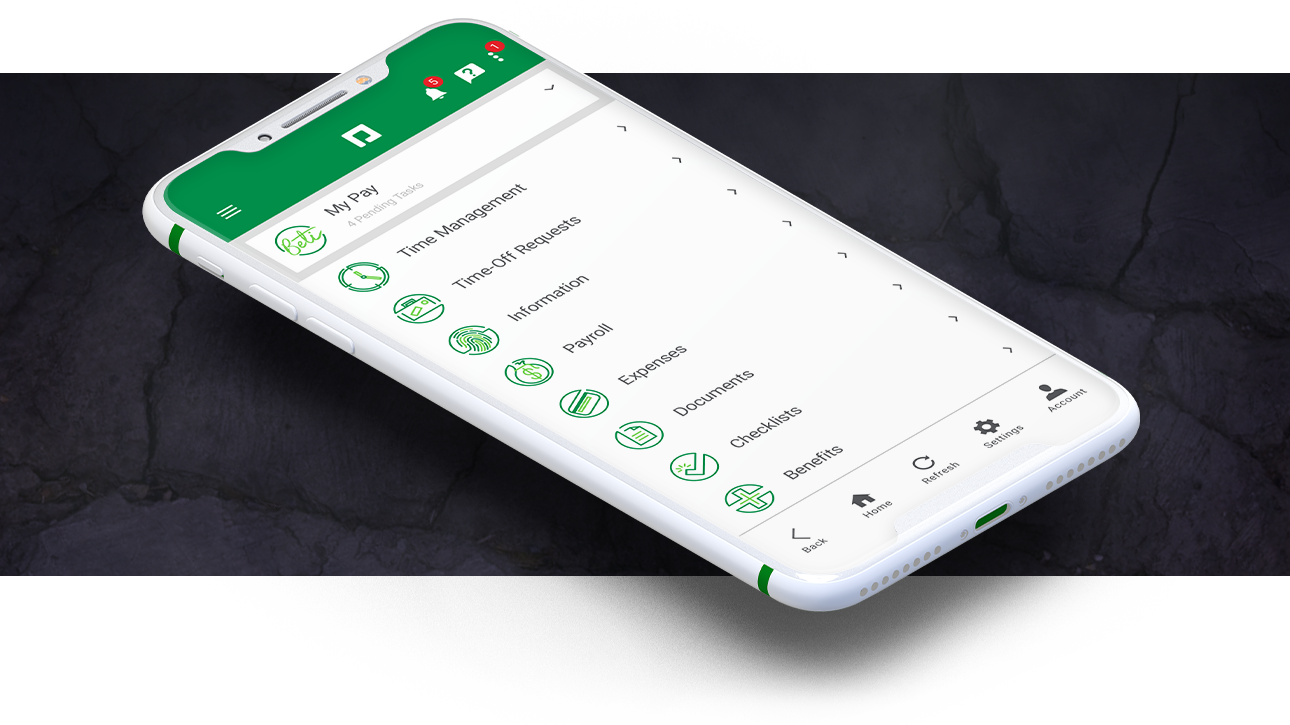

But Unnecessary Action Hero is coming off the top rope with Paycom’s Employee Self-Service®. With Employee Self-Service, employees can instantly see PTO accruals. At the touch of a button, they can send PTO requests to their direct supervisor. No more getting paper forms signed, returned and filed deep in the abyss of a paper file folder.

Stealthy stubs

Paper pay stubs are the most wanted fugitives of the document world. They vanish without a trace, and they’re probably living under an assumed name in an undisclosed location. Then the time comes when an employee wants a car, a home or a loan. Suddenly, it’s your responsibility to hunt down their paperwork.

When it comes to disappearing documents, Unnecessary Action Hero has seen a thing or two. He once got a pay stub written in Morse code in invisible ink in Double-Reverse Pig Latin, which isn’t even a thing. Then it self-destructed.

It was so unnecessary, he started tracking his pay stubs in the easy-to-use Paycom app. Today, he’s on a mission to end paper pay stubs once and for all. And he’ll keep going as long as necessary.

Unnecessary Action Hero is on the case.

And unnecessary HR tasks don’t stand a chance.

Paycheck mysteries? He won’t have it. Benefit blind spots? Not on Unnecessary Action Hero’s watch.

With an unnecessarily intense helping hand, he puts PTO and pay stubs at the fingertips of your workforce. He lets employees review and approve their paychecks before direct deposit occurs. Easy access to benefit plans and costs? Check. And it’s all through the power of Paycom.

Is our Paycom-powered hero a little too good to be true? Not necessarily. Visit his website to see him save one family’s vacation in the most unnecessary way imaginable.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.