401(K) Reporting

Easily and securely send retirement data to and from your 401(k) provider

What it does

The easiest way to manage retirement data

Stuck manually adjusting retirement data while dealing with frustrating formatting issues? Stop wasting time with an error-prone process. Instead, automate it with our easy-to-use retirement reporting tools. Every pay period, our tech automatically updates and sends your workforce’s pay, contribution and demographic data straight to your 401(k) provider. And it automatically sends any changes employees make on a provider’s site back to you. For extra peace of mind, you receive a detailed report of the transmission within 24 hours.

Errors end here

Even a pro like you can’t flawlessly rekey retirement data forever. Since our retirement reporting tools exist in our truly single software, it automatically syncs salary info, employee and employer contributions, loan amounts and more without requiring you to manually enter it. That saves you from the hassle of catch-up contributions due to wrong matches or deposits.

Close the loop on communication

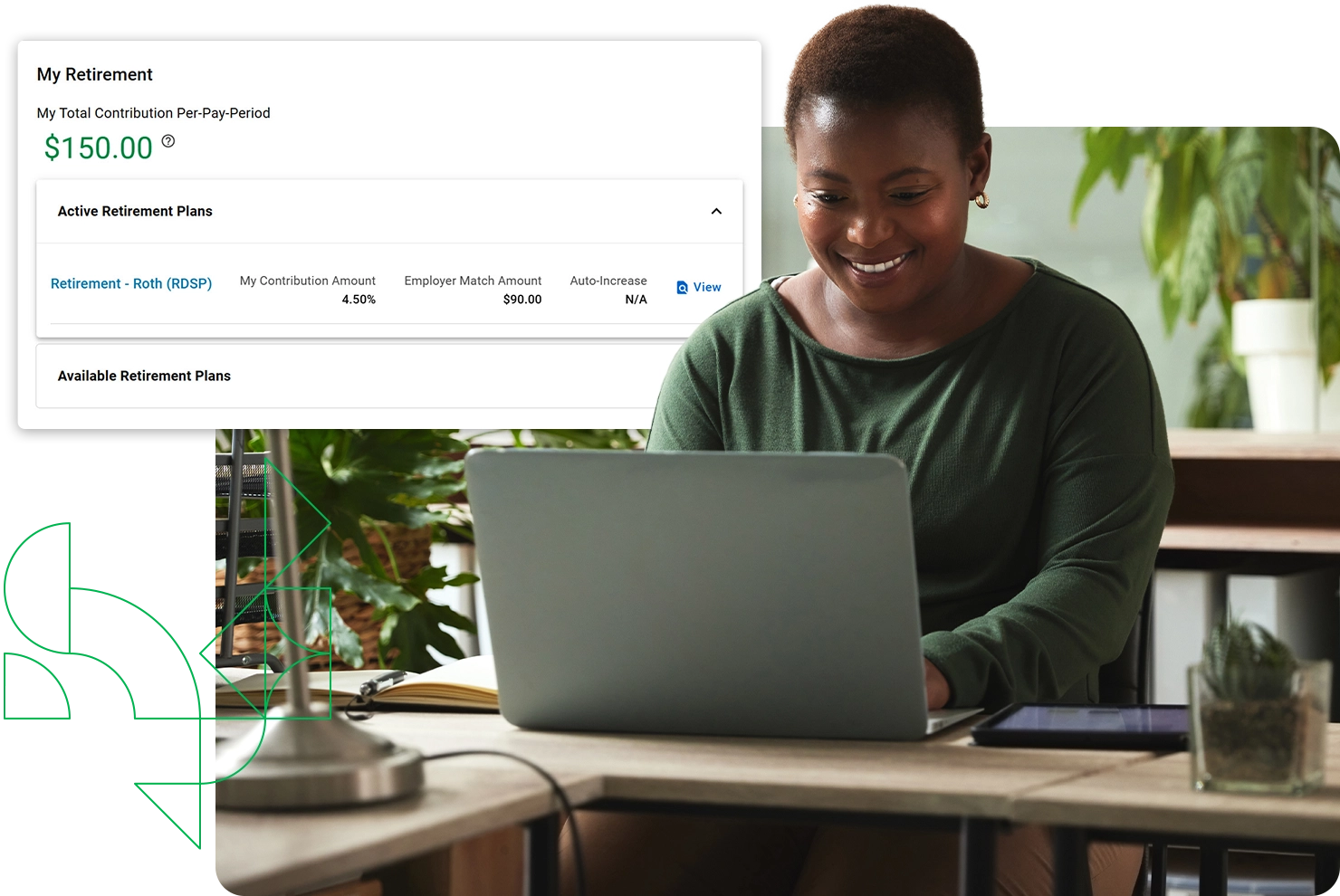

When your employees only modify their information on a retirement provider’s site, you could easily miss important updates to payroll. With our single software, any deduction changes from select retirement providers automatically update in Paycom — all in exactly the right format and in one convenient place to view every change.

Eliminate time-wasting tasks

Your role’s too important to sink hours into retirement reconciliation. With our retirement reporting tools, you can finally stop manually:

- tracking employee contributions and employer matches

- updating your 401(k) provider’s website after every payroll

- making adjustments to account for payroll changes

Minimize exposure and extra work

When something goes wrong with retirement data, it falls on you. Our tech helps limit your organization’s liability by ensuring correct contributions and helping you easily prepare in the face of tight deadlines. And since it automates sending data to and from your 401(k) provider, you don’t have to worry about wrestling with troublesome files and formats.

How it works

Automate your retirement pains away

Never stress over carrier communication again

When one thing doesn’t add up, it brings your entire strategy into question. Our single software automatically syncs with your workforce retirement data — even from providers’ sites — to help eliminate that margin for error. We collaborate with select plan providers to ensure your data works with their requirements and unique formatting specifications. And once that’s ensured, our software automatically generates needed files and delivers them to your carriers. It’s that simple.

Retire inconsistent data

Our retirement reporting tools work in the same single software as all our tech. One login. One password. And one seamless flow of data to ensure accuracy and save you from rekeying anything. Once an employee sets their contribution, Paycom handles the rest and ensures this data gets to and from your carrier safely and securely.

See what people are saying about 401(K) Reporting

401(k) Reporting connects seamlessly with

After employees easily enroll in benefits and select their contributions, that data automatically flows into our 401(k) Reporting tool to ensure accuracy.

Beti®

If an employee notices anything off about their 401(k) contribution, our self-service payroll experience guides them to resolve this issue before submission. This helps ensure bad data never gets to your carrier.

Want to know how well employees engage with your benefits? Report Center makes it easy to gauge participation and average contributions for 401(k)s and other plans you might offer.

Frequently asked questions

Learn more about 401(k) reporting software

401(k) benefits administration software is technology that simplifies the process of collecting data related to employees’ 401(k) retirement plans and transferring that data to 401(k) providers. Ideally, this tech is used in tandem with payroll software — or directly connected to it — to eliminate errors and reduce manually rekeying info.

By automating 401(k) deductions, planning and the flow of data to and from retirement providers, employers can:

- eliminate errors caused by rekeying data

- free HR professionals from time-consuming tasks

- ensure formatting matches their carriers’ requirements

- reduce legal exposure from incorrect contribution amounts

- prevent costly catch-up contributions due to incorrect matches or deposits

First, the field data in Paycom’s 401(k) files is customized to meet the exact specifications of 401(k) providers to ensure correct formatting. Then, our 401(k) reporting software automatically updates based on your payroll data and updates we receive from select retirement providers, eliminating the need for admins to rekey this data before they send it to your carriers.

Your employees can easily view their 401(k) plan documents anytime through Employee Self-Service®. This same easy-to-use app lets your people enroll in their benefits, too. While they consider their 401(k) contribution, our intuitive experience lets them easily test the impact the deduction will have on their take-home pay.

Paycom provides custom retirement plan deduction codes that are set up with the correct tax treatment to align with any retirement plan. Common types requested and supported include:

- traditional and Roth 401(k)s

- 403(b)

- 457(b)

Having all employee data in one software eliminates the need for data reentry between multiple applications and simplifies the flow of data to and from providers, reducing potential inconsistencies and errors while giving time back to HR.

Retirement reporting tools automate an otherwise time-consuming process, resulting in potential savings by reducing:

- labor costs

- payroll processing time

- errors and the associated risk of penalties