COBRA ADMINISTRATION

Help shield your business from violations, fines and penalties with automated software

What it does

Take the bite out of COBRA compliance

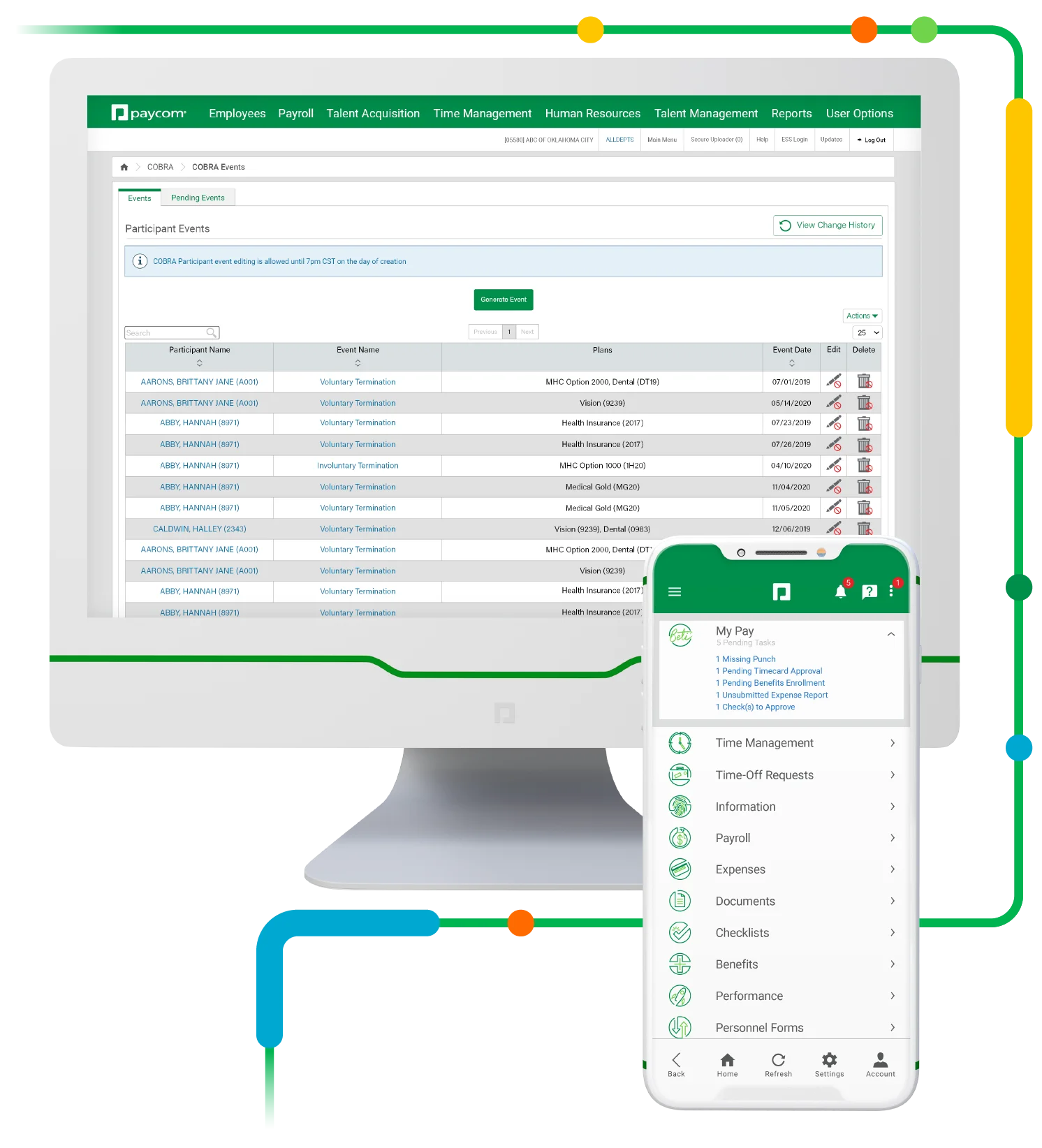

Ensuring COBRA compliance can be a massive undertaking filled with pitfalls. And just one small misstep leaves you — not your insurance company — liable. Our COBRA tool helps you avoid that stress and those risks by automating your COBRA administration within Paycom’s truly single software.

Tame the COBRA process

With Paycom, you enter employee changes once and only once, freeing you from correcting time-consuming data errors. Plus, we’ll send the required initial notices and other correspondence by certified mail to current and former employees for you. And after an election notice is sent to a qualified beneficiary, we’ll track every important deadline, collect premiums and remit payments. We’ll even handle employee questions on your behalf and send monthly statements detailing your company’s COBRA transactions for easy reconciliation, so you can stay on top of — instead of crushed by — your compliance process.

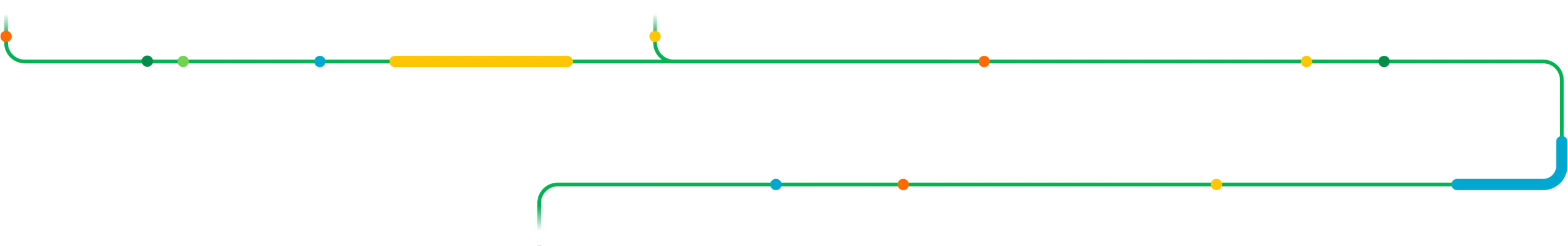

COBRA Administration automatically and proactively prompts you to generate election notices for:

- death

- divorce

- retirement

- leave of absence

- dependents who age out

- voluntary termination

- termination with severance

- open enrollment for COBRA participants

- involuntary termination (excluding gross misconduct)

- reduced hours due to moving from full-time to part-time under ACA

- and more

Why it matters

Your antidote for COBRA headaches

Compliance is important, sure. But keeping up with extensive rules and tight deadlines gets exhausting. We’ll help you navigate COBRA with confidence without the burden of endless tasks, leaving you with much-needed peace of mind in the face of audits or lawsuits.

Our COBRA Administration tool makes it easy to:

- track key dates

- keep up with required payments

- manage and send relevant COBRA documents

Simplified correspondence

When it comes to COBRA compliance, it’s not enough to stay aware of dates. You also have to contact participants and qualified beneficiaries. We take that burden off your plate by communicating with them on your behalf.

Effortless reporting

Tired of hopping between systems to meticulously create a benefits report? Our intuitive reporting tools exist in one convenient place, so you can easily assemble the exact data your carriers need.

World-class service

With Paycom, you never need to face a COBRA issue alone. For general questions or in-depth troubleshooting, you’ll enjoy a dedicated Paycom specialist primed to address your org’s unique needs.

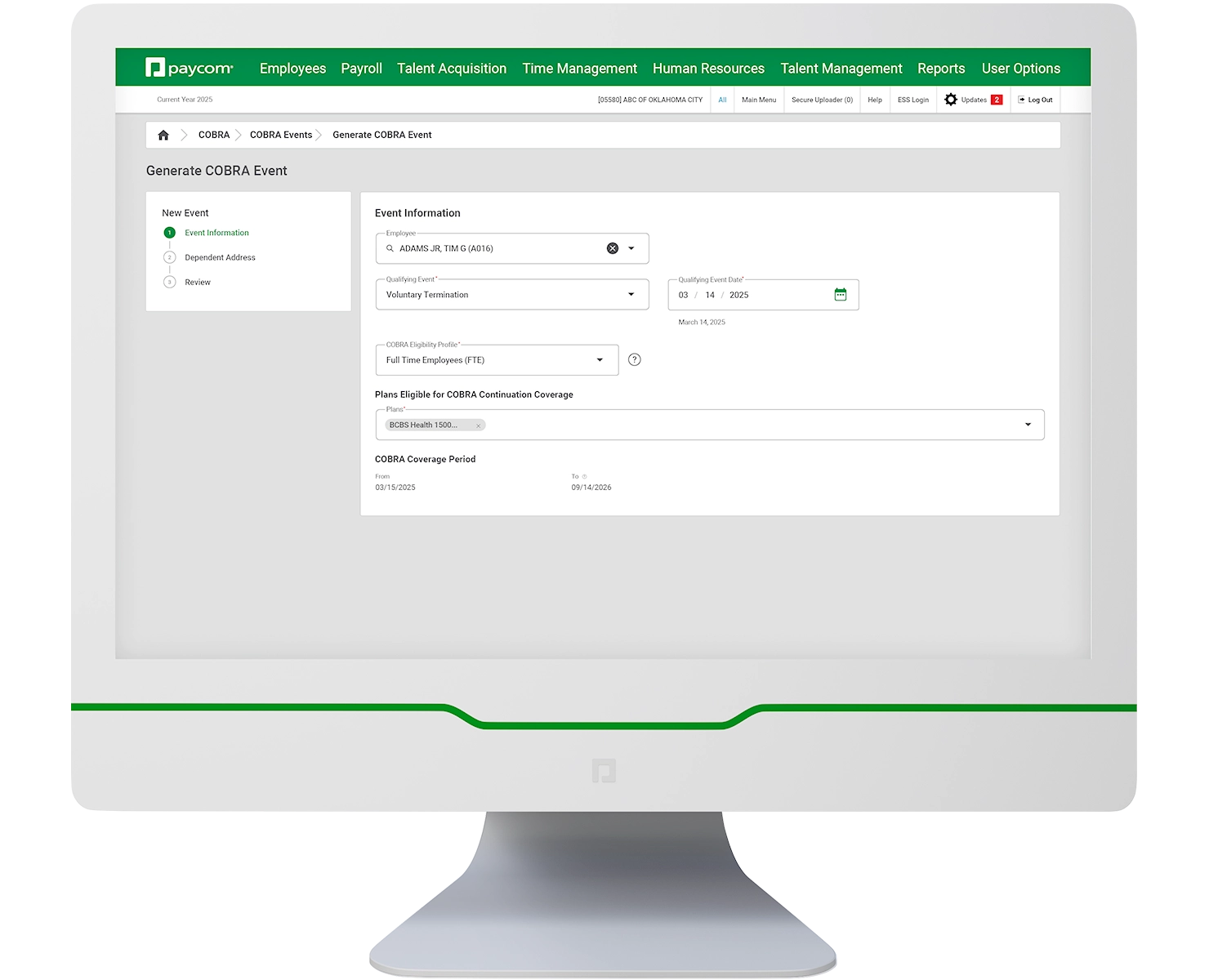

How it works

Put your COBRA woes to sleep

Whether it’s through processing important regulatory changes, communicating updates or automatically tracking important dates, we’ll help close the gaps so it’s easier for you to own your COBRA compliance. Plus, everything you need to ace COBRA is available in our single software with just one login and password.

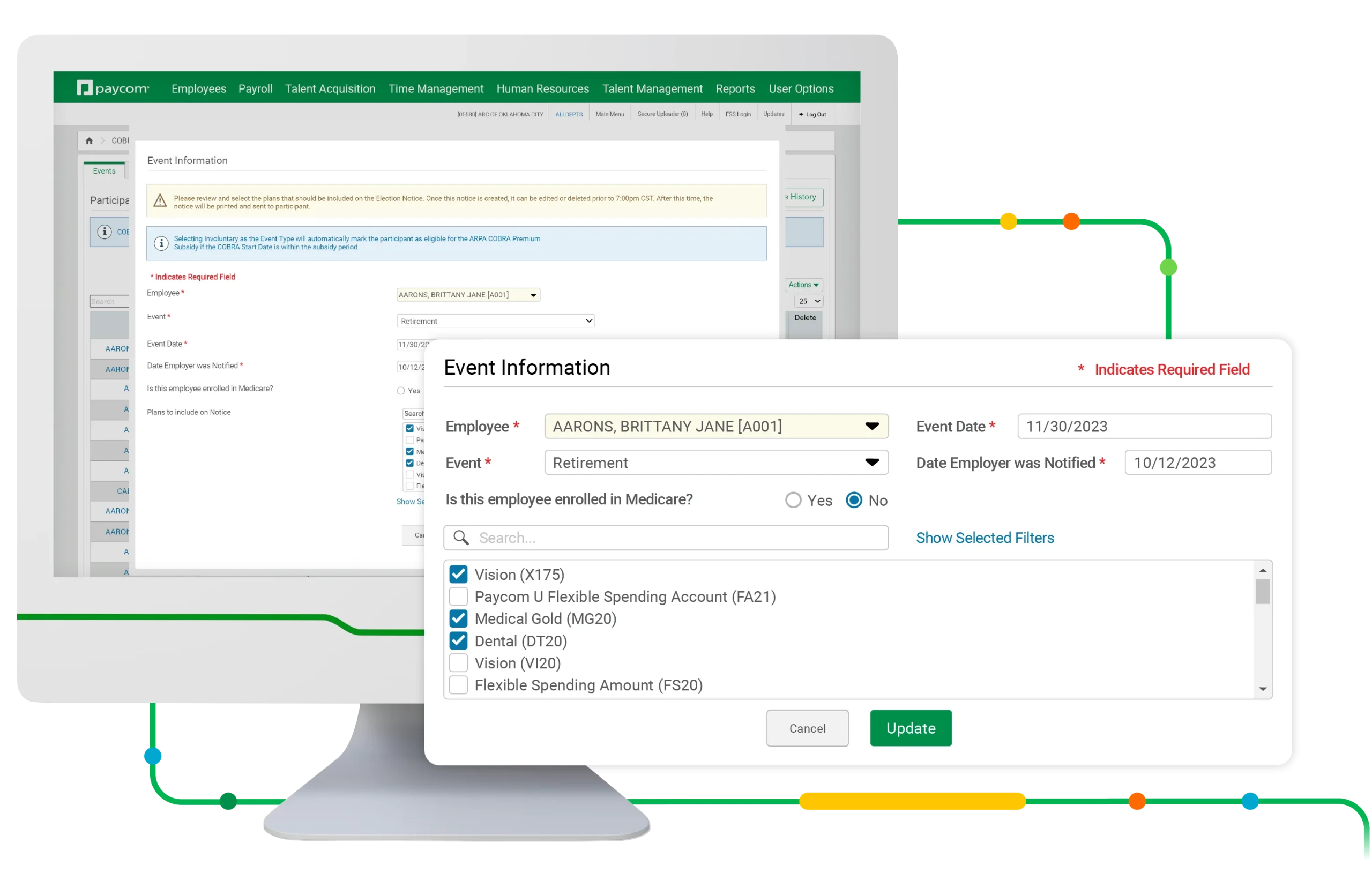

A report for every need

Need insight on a specific piece of your COBRA compliance? No problem. Our reporting tools make it easy to see where participants are in the process, COBRA rates by case or benefit plan, reconciliation of costs and more.

Much-needed clarity

Sure, your org complies with COBRA. But current and former employees actually benefit from it. Through Employee Self-Service, participants can easily make payments, view historical benefit plans, access notices, add dependent info, update their address and find answers to common questions.

Automated reconciliation

Your role’s too important to spend it reconciling data. Any payments made through Employee Self-Service® flow into our reporting tool in real time, so you know exactly which participants have paid their share.

Easy-to-manage extensions

No need to fuss with extensions. Our COBRA software automatically notifies participants in advance about adding months of coverage. Once we receive their request and you authorize it, that’s it. The extended coverage automatically reflects in Paycom.

A report for every need

Need insight on a specific piece of your COBRA compliance? No problem. Our reporting tools make it easy to see where participants are in the process, COBRA rates by case or benefit plan, reconciliation of costs and more.

Automated reconciliation

Your role’s too important to spend it reconciling data. Any payments made through Employee Self-Service® flow into our reporting tool in real time, so you know exactly which participants have paid their share.

Much-needed clarity

Sure, your org complies with COBRA. But current and former employees actually benefit from it. Through Employee Self-Service, participants can easily make payments, view historical benefit plans, access notices, add dependent info, update their address and find answers to common questions.

Easy-to-manage extensions

No need to fuss with extensions. Our COBRA software automatically notifies participants in advance about adding months of coverage. Once we receive their request and you authorize it, that’s it. The extended coverage automatically reflects in Paycom.

How Your COBRA Administration May Leave You Exposed

Though many employers are required to offer COBRA, that doesn’t make following it easy. With the law’s costly violations — including daily taxes and penalties — it pays to comply. Read how Paycom’s COBRA Administration tool makes it simple to protect your business from noncompliance.

Comprehensive convenience

Cobra Administration seamlessly connects with

With our Benefits Administration tool, COBRA Administration automatically and proactively updates you for easily missed qualifying events like an ineligible dependent. And with the Benefits to Carrier enhancement, Paycom automatically sends COBRA insurance info to your carriers.

Through our intuitive self-service experience, participants can easily enroll in COBRA coverage, access their COBRA notices, see their transaction history and even make premium payments. Plus, those payments flow seamlessly to reporting for easy visibility and better communication.

From retirement to termination, all COBRA-qualifying events entered on a Personnel Action Form result in proactive notifications to close the gaps. Once that PAF is submitted, our tech automatically prompts an alert, asking if you want to generate an initial notice for COBRA coverage eligibility.

Frequently asked questions

Learn more about COBRA compliance

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is an amendment to the Employee Retirement Income Security Act, the Internal Revenue Code and the Public Health Service Act that requires group health plans to provide a temporary continuation of group health coverage that may otherwise be terminated.

COBRA requires continuation coverage to be offered to the following individuals when they would otherwise lose their group health coverage due to certain events, like job loss or reduction of hours:

- covered employees

- spouses

- former spouses

- dependent children

COBRA can last for 18 months for termination of employment (whether voluntary or involuntary), including retirement or loss of employment hours.

COBRA can last for 36 months for the qualifying events of:

- death of the covered employee

- divorce or legal separation of the covered employee from their spouse

- the covered employee becoming entitled to Medicare

- a dependent child losing eligibility when turning 26

COBRA can also be extended an additional 11 months for those who qualify for the disability extension, resulting in a total coverage period of up to 29 months.

A “secondary event” is a qualifying event after the initial COBRA event. This includes any situation where dependents lose COBRA access due to the primary qualified beneficiary experiencing a secondary qualifying event.

For example, an employee divorces his spouse with children. The spouse, along with the children, would be eligible for COBRA. If one of the adult children ages out at 26, this would qualify them to continue under their own COBRA plan.

The IRS excise tax penalty is $100 per day for each qualified beneficiary ($200 per day if more than one family member is affected).

Under Department of Labor ERISA penalties, an employer is liable up to an additional $110 per day per participant if they fail to provide initial COBRA notices.

COBRA software is technology that makes it easier for employers to comply with the Consolidated Omnibus Budget Reconciliation Act. The exact application of these tools can vary, but the ideal software should help employers stay on top of key deadlines and streamline communication to participants and qualified beneficiaries.

COBRA administration software pulls HR out of a tedious, time-consuming task without risking legal violations, fines and penalties. These tools can:

- automate correspondence to COBRA recipients

- notify HR of qualifying events

- address common employee questions

- send monthly statements detailing COBRA transactions

- and more

Paycom’s COBRA Administration tool uses automation and intuitive reporting to help you navigate compliance with confidence. Our software automatically:

- tracks important dates and deadlines

- administers payments

- manages COBRA documents

- notifies employers about COBRA-qualifying events

- informs employees about COBRA extensions

- and more

This takes a significant load off your organization, especially as it relates to communicating with qualified beneficiaries and COBRA participants. Plus, since COBRA Administration exists in our truly single software, any reports you need prepopulate with real-time data in one convenient location. And should any questions come up, you can easily turn to your dedicated Paycom specialist for support.

While employers are ultimately responsible for their own compliance, Paycom helps ease that burden by managing all employee questions and most of your COBRA-related tasks.

For example, we’ll collect and remit all payments from COBRA participants back to you. (Keep in mind, however, your organization must pay the appropriate insurance provider directly.) This ensures COBRA participants remain active with their insurance and that your organization never pays out of pocket for someone who has terminated their coverage.

Yes, Paycom administers all secondary events after the participant notifies their employer.

Our COBRA Administration software lets you easily generate customizable reports over:

- COBRA rates

- participation

- enrollment

- payments

- and more

Yes, Paycom handles all correspondence and questions from COBRA participants, so you don’t have to. We’ll also address any of your organization’s questions, should you have any.