Garnishment Administration

Reduce your company’s liability and your workload

What it does

Deduct stress from your garnishment process

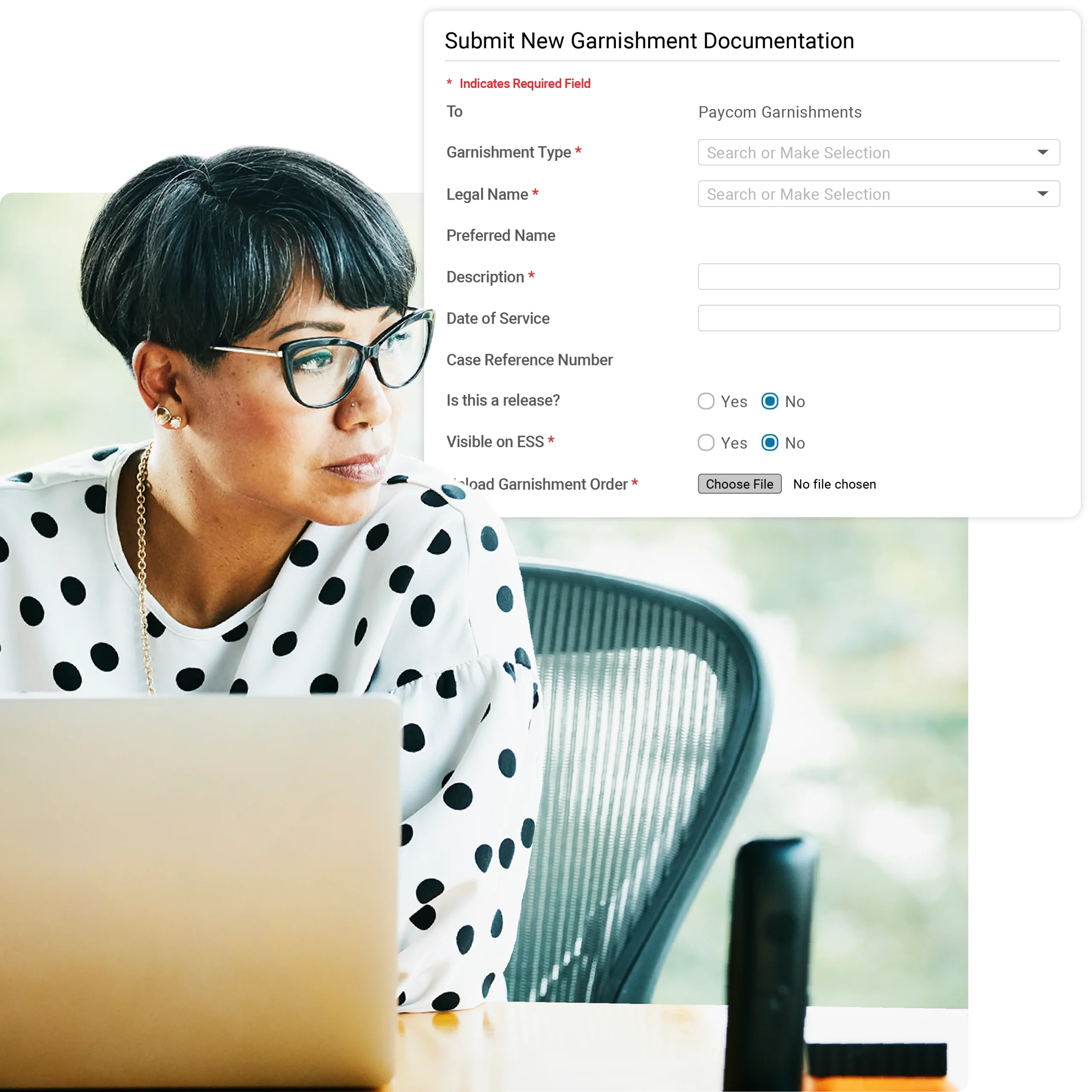

Even if you have payroll down to a science, garnishment orders can throw an unexpected wrench in your process. With your company’s compliance on the line, it pays to have a provider you can trust. Once you submit an order through our secure uploader, our team of garnishment experts handles the rest. We’ll take care of an intimidating, multistep process and you’ll enjoy lower liability. It’s that easy.

Why it matters

Set the stage for easy wage garnishments

From complicated tasks to tight deadlines and everything else on your plate, it’s easy to mishandle garnishments. But since we tackle the hard stuff, you can finally put your garnishment headaches to rest.

World-class service

Stop wondering if you administered garnishments correctly. Our team of experts will make sure any order you submit gets handled accurately and on time. Plus, an easy-to-use dashboard ensures you have the visibility you need right in our single software.

Painless prioritization

Overwhelmed by a wave of orders? Whether you have a few or a mountain of garnishments to address, we’ll automatically prioritize and administer them as required by federal and state laws.

Less risk, less work

Added liability never makes your job easier. Using our wage garnishment service, you help avoid the risk of miscalculating orders, missing important dates, letting orders slip through the cracks and leaving your company on the hook for severe financial penalties.

How it works

Collect peace of mind, not stress

Frustrated by garnishment orders? Let our team take them off your plate. We’ll handle the calculation, payments (even electronic ones) and recordkeeping. From the moment you get an order to when it expires, we’ll take care of it — so you don’t have to.

Close the loop

Stop spinning plates. We reconcile all garnishment payment amounts, calculations and third-party payees. Plus, we’ll send payments, address key documents, complete answer sheets and fulfill any other items specified in an order. Best of all, our single software automatically manages garnishment deductions in payroll and follows the orders’ stop dates, so your compliance is airtight.

Constant communication

No time to speak with third-party payees? Don’t sweat it. Our garnishment experts will work with your dedicated Paycom specialist and contact any relevant parties on your behalf.

True transparency

Garnishments affect employees, so shouldn’t they have insight into their orders? Absolutely, but they don’t have to come to you to get them. They can see every payment they’ve made in Employee Self-Service® on the Paycom mobile app.

One software for all your garnishment needs

When business moves fast, you don’t always have the time to call your tech provider. And that’s OK! You can find any garnishment-related updates in our single software — with just one login and password.

Close the loop

Stop spinning plates. We reconcile all garnishment payment amounts, calculations and third-party payees. Plus, we’ll send payments, address key documents, complete answer sheets and fulfill any other items specified in an order. Best of all, our single software automatically manages garnishment deductions in payroll and follows the orders’ stop dates, so your compliance is airtight.

True transparency

Garnishments affect employees, so shouldn’t they have insight into their orders? Absolutely, but they don’t have to come to you to get them. They can see every payment they’ve made in Employee Self-Service® on the Paycom mobile app.

Constant communication

No time to speak with third-party payees? Don’t sweat it. Our garnishment experts will work with your dedicated Paycom specialist and contact any relevant parties on your behalf.

One software for all your garnishment needs

When business moves fast, you don’t always have the time to call your tech provider. And that’s OK! You can find any garnishment-related updates in our single software — with just one login and password.

See what people are saying about Garnishment administration

Comprehensive convenience

Garnishment Administration seamlessly connects with

Beti®

Garnishment deductions automatically flow into our self-service payroll experience, giving employees insight and ensuring no data gets miskeyed.

Through our intuitive self-service tool, your people gain full, 24/7 visibility into their history of garnishment payments.

Our comprehensive predefined garnishment report simplifies reviewing orders submitted by either a historical payroll transaction or the pay date of your choosing.

Frequently asked questions

Learn more about wage garnishment software

Garnishment software is a tool that helps employers factor wage garnishment orders into payroll. It helps simplify deductions and ensure they accurately pull from an affected employee’s check. Certain tech can even automatically halt garnishment deductions whenever an order expires.

Garnishments are generally divided into two categories: wage and nonwage. While nonwage garnishments attach directly to a debtor’s bank to collect funds, wage garnishments pull a portion of an employee’s check each pay period. While a financial institution may manage a nonwage garnishment, employers are responsible for ensuring wage garnishments accurately deduct from an employee’s pay.

Wage garnishment tracking and management services work by processing the garnishment orders employers receive. With Paycom’s Garnishment Administration service, for example, we handle the calculations, payments (including electronic) and recordkeeping on your behalf. We also complete answer sheets and additional documents the court administering the garnishment may expect. We even communicate with third-party payees about your orders.

While garnishments directly impact employees, businesses can face fines and other penalties for failing to comply with orders. Automated garnishment processing takes this burden off employers, lowering their liability. With Paycom, you simply send us an order through our secure file uploader and that’s it. We’ll ensure the garnishment is accurately deducted from your employee’s pay until its stop date.

If an employer fails to comply with wage garnishment notices, they could face financial penalties, court costs and other fees. Through our Garnishment Administration tool, we handle calculations, payments and recordkeeping for employers once they inform us of a garnishment order.

When you send an order to Paycom, our garnishment experts calculate and reconcile all deductions. We also take care of the administrative tasks of sending payment and documentation, as well as completing any answer sheets and other paperwork associated with the order. Additionally, we track all garnishment deductions every pay period to ensure proper records.

Our garnishment experts work with your dedicated Paycom specialist to resolve and process garnished wages and communicate with all parties involved.