Small business payroll software

Focus on your growth and customers with our automated payroll tech

Why Paycom

Because payroll shouldn’t be a growing pain

When you run a tight ship, everything on your plate can seem huge. Whether you need to ensure a constant cash flow or make the most out of your time, an error-prone and time-consuming payroll process keeps you from focusing on your business. Try taking shortcuts with unreliable tech or risky workarounds, and you could expose your employee data to cyberthreats.

It doesn’t have to be this way. Paycom’s full-solution automation ensures a quick, stress-free and accurate payroll process protected by our formally audited and ISO- and SOC-certified security standards. So you can get back to winning new customers, building your brand and focusing on the future of your organization.

HOW WE HELP

Payroll built to keep you moving

Since data flows seamlessly into payroll within our single software, it self-starts each period — you never have to rekey a thing. Plus, our tech automatically finds errors and guides your employees to fix them before submission to ensure precise payroll every time. We’ll even issue checks off our own account to reduce bank charges and simplify your ledger. And as our experts handle the hassle of payroll taxes, you’ll finally have the space you need to focus on the big picture.

COMPREHENSIVE CONVENIENCE

Payroll tools and services to help you thrive

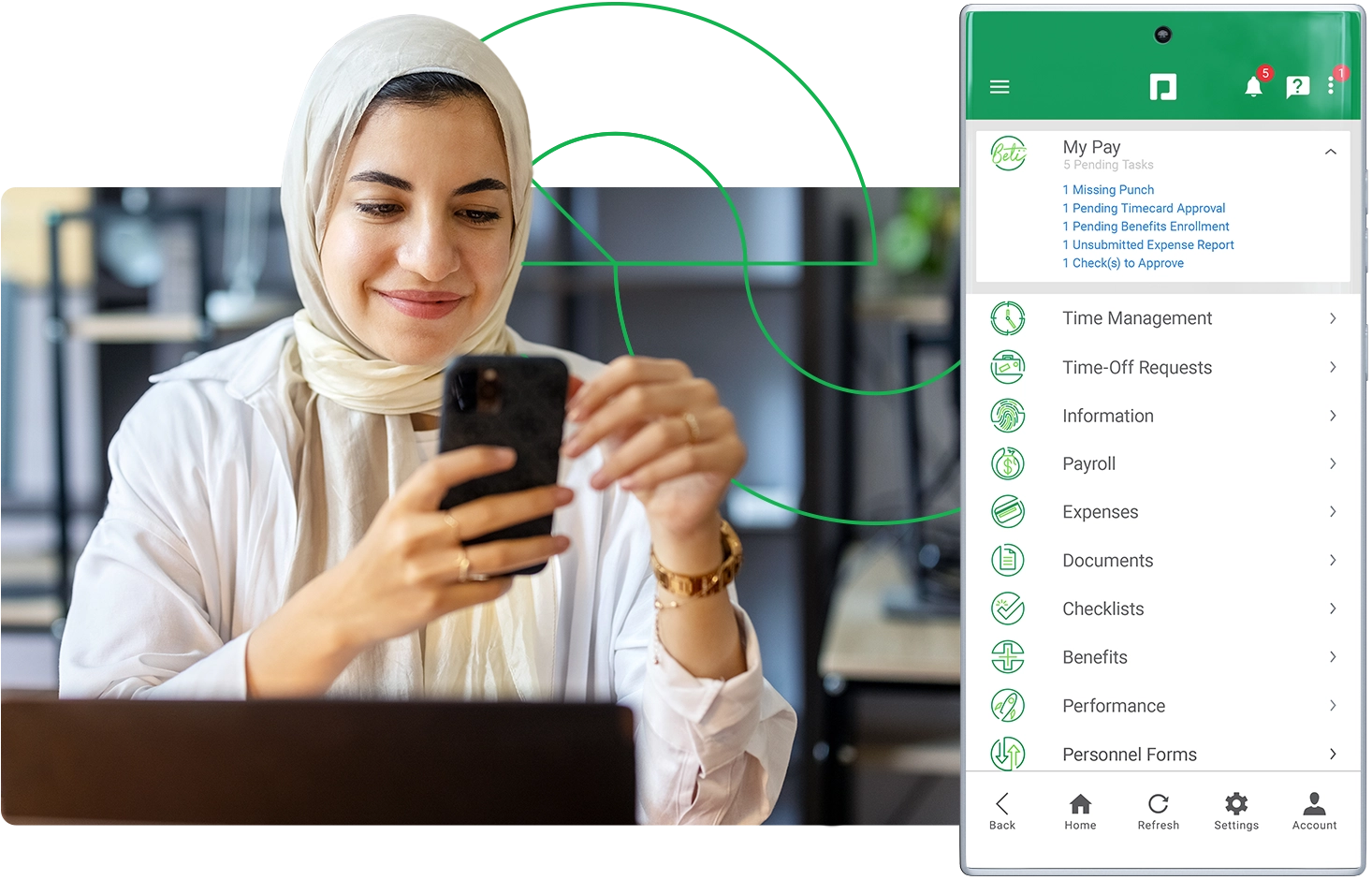

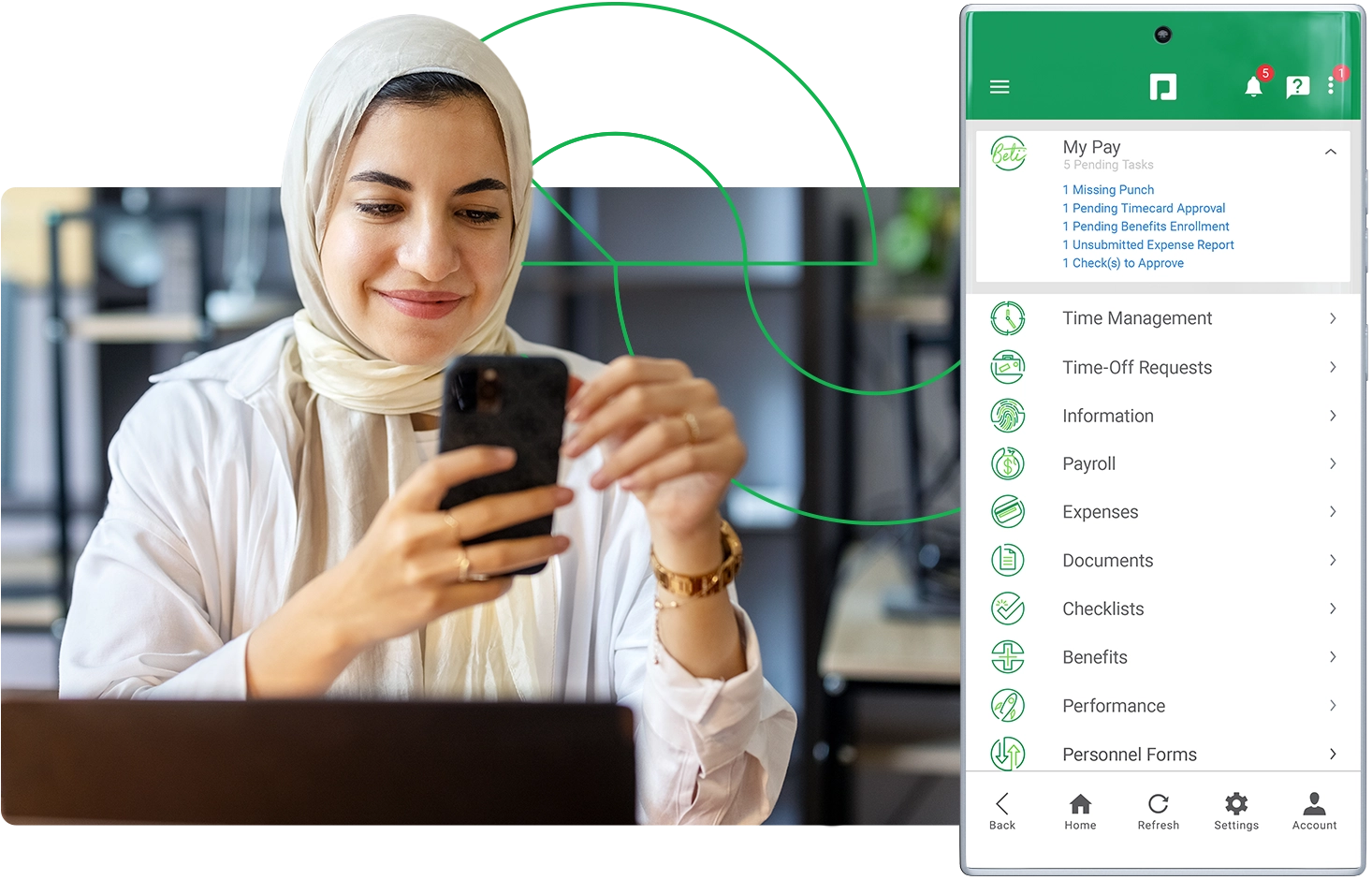

Beti®

Our automated payroll experience finds issues and guides your employees to fix them before submission, ensuring a seamless process without keeping you in the weeds.

Our tax specialists will help lighten your compliance workload, file your IRS Forms 940 and 941 and even automatically debit your payroll taxes when needed.

No more losing hours to rekeying data. Our general ledger tool generates perfectly mapped reports that you can easily import into the accounting software of your choice.

See what small businesses are saying about paycom

Real Results

How an Amazon DSP Delivered Excellence With Automated Payroll

The stakes are high when your small business delivers for one of the world’s largest companies. See how our automated payroll software allowed the owner of this Amazon delivery service partner to easily pay his workforce without wasting late nights fixing errors.

“Before Paycom, I was up until 3 in the morning just to make sure I made payroll in time.”

—DSP owner

Frequently Asked Questions

Learn more about Paycom’s payroll software for small business

Yes! But keep in mind, not all payroll software is built the same. Paycom’s industry-first payroll experience utilizes automation to self-build each scheduled payroll cycle and flag errors as it goes. Then it guides employees to fix those issues before payroll is even submitted, so payday brings 100% accuracy instead of surprises.

Some small businesses may rely on an individual — with little to no payroll experience — to process payroll in a basic accounting program with a low price tag.

However, huge expenses exist on the back end: tax compliance issues, fines, civil penalties and tons of needlessly allocated hours. Add those up and you’ve spent more on the cheaper tool than you would have on a comprehensive payroll software solution.

Employers should consider the best options for their employee head count, industry and employee types (hourly, salary, billable, full-time, temporary, etc.). As your business grows, even modest increases in head count unlock new compliance burdens. Your processes will quickly become more established and need to be streamlined.

Be sure to consider the employee experience and how the right tool can actually help with employee retention. Meet with a Paycom representative today and let us tailor a solution to fit your business's needs.

Several options for small business payroll are available, but ours is built to scale with your small business and your employees. Don’t just take our word for it; let us show you the Paycom difference. Meet with us to see for yourself.

If you want to build and expand your business, with the highest and best use of your time, you need payroll software. Otherwise, manual calculations, tax errors, legal issues and other time-consuming problems await the business owner who takes payroll into their own hands.

With Paycom, you’re assigned a dedicated specialist who truly knows your business.